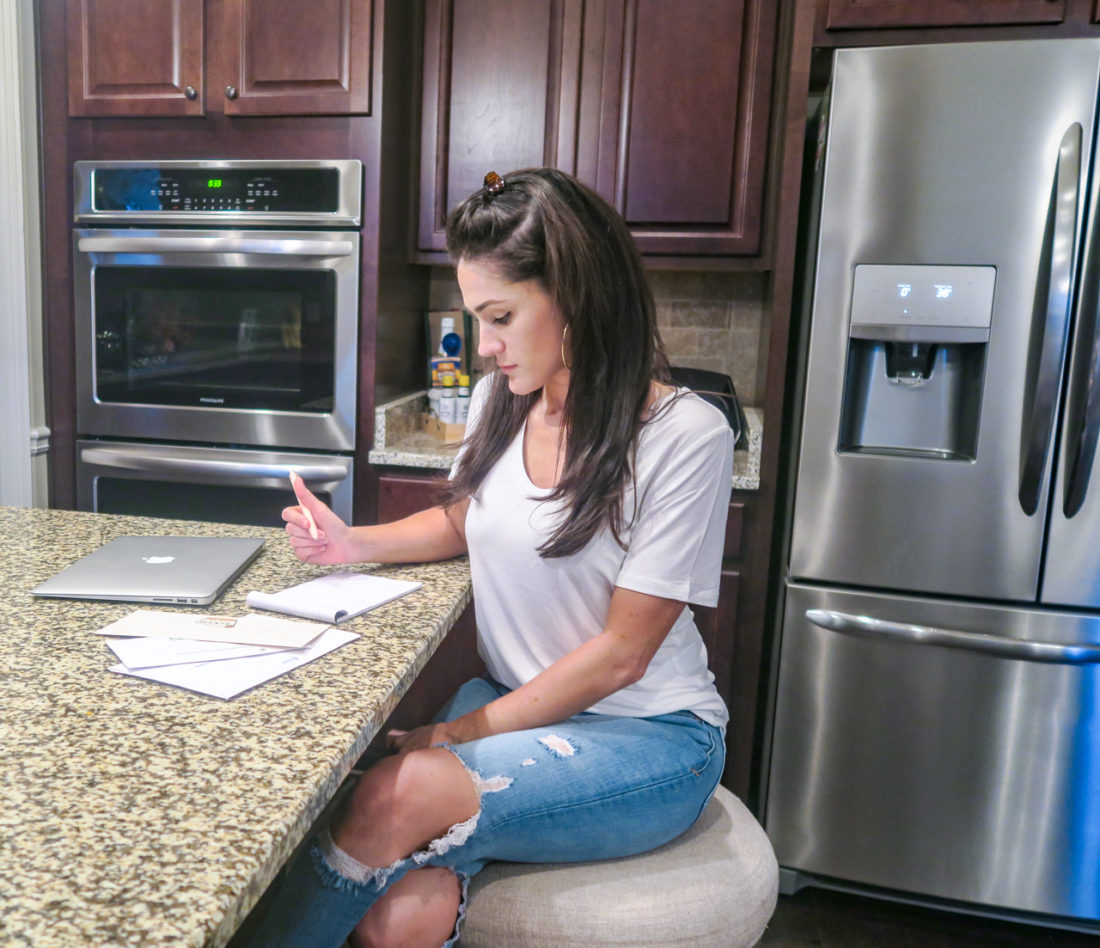

My Credit and How I Fixed it Fast

- 10 Comments

- ATLANTA, GA

Thank you CreditRepair.com for sponsoring this post. CreditRepair.com’s team understands

that a credit score is not just a number; it’s a lifestyle. This post may also contain affiliate links,

earning me a small commission if you click, at no additional cost to you.

Like most young people I never really paid mind to whenever my mom would mention having good credit and not abusing credit cards. My mom is a stickler for budgeting, finance, and just being responsible with your money. Unlike my mom…..as a young 18 year old then as 20 something all I saw was the ability to swipe a card even when I had no money in the bank. Does this sound like you? This is a huge mistake so many young people make with their credit when they turn 18.

"Everyone has a right to: Achieve their dreams. Increase their ability. Enjoy a lifestyle of greater opportunity."

- CreditRepair.com

i was in over my head

Initially, I tried to make all of my payments on time and keep my credit score up. Eventually, having multiple $30 monthly payments caught up to me and one-by-one I started letting each one go. Then came the phone calls and collection notices in my mailbox. Within a matter of months my credit score tanked. Is this starting to sound familiar? I thought so. Even then, I still didn’t really care. The idea of owning a home or walking into a dealership to purchase a car seemed light years away. I figured these marks on my credit would roll off by the time I needed to make a big life purchase. WRONG. Good Credit is important no matter what stage of life you are in. What I didn’t realize was that if I’d had good credit I would have probably saved hundreds, even thousands of dollars in interest!

having bad credit taught me a lesson

The only thing having bad credit taught me, was to only live on the cash that I had in the bank. I had to budget every paycheck but everyone should live like this even when they have good available credit. I used to hear time and time again, “Only buy things with your credit if you can afford to pay for them in cash.” This is so true. Things have a funny way of sneaking up on you in life. We all know that emergency situations come at the worst times. For me, several years into having bad credit, I also had two kids, which meant daycare bills were factored into my cash-only budget. I also had an older car since I was unable to buy a new one. This meant car repairs were inevitable.

I knew I needed to make a change because no matter how much I ignored those collection letters and phone calls, they would not stop coming. I was drowning in debt and suffering from severe anxiety because of it. We couldn’t buy a car without an astronomical interest rate. Paying credit card bills seemed pointless yet we still found a way to go out to eat and spend a hundred dollars on a meal we could have prepared at home. We couldn’t buy a home and all of our friends were buying homes with no problem. This was no one’s fault but our own. How could we justify going out to eat several times a month but not pay the bills we racked up? In 2018, we needed to buy a home due to unforeseen circumstances so we needed to make a change fast. Here’s what we did.

stop using your credit cards immediately

If you are still using your cards for random purchases stop now! You are most likely racking up more than you can afford to pay and when you add in interest you are digging yourself a hole that you will have a hard time getting out of. Remember to live like this is cash in the bank. If you don’t have enough to pay cash, don’t swipe that card. If your friends want to go out for dinner and drinks, don’t go. Offer for them to come over for a potluck instead!

pull your credit report

This is vital so that you can see what is helping you and what is hurting you. You can pull your credit report free once per year. Once you pull your report you will be able to check your balances owed. Print this report out so that you can cross off items as you tackle them.

dispute old items

We all know that collections take 7 years to roll off. Late payments take 4 years and inquiries take 2 years. That being said, mistakes can be made and sometimes old items are just sitting there hurting you. Make sure you do your research. If an item is past the reporting date dispute it with each credit bureau. You can do this easily online and results are usually finished within 30 days.

pay off your smallest balances

I had lots of collections that were for small amounts. Having 10 Small collections is so much worse than having one large one. Some of my collections were for medical bills and others were for credit cards. They ranged in amount from $50 to $500 so first I took on the small ones that showed on my report. Any balances that were under $500 I paid them off. Most of us can come up with a few hundred dollars extra just from not eating out or skipping fancy coffee every day. Paid off balances as opposed to settlements give you more leverage later when trying to remove the bad marks from your report.

make the hard phone calls

In my opinion this is the single most important, yet frightening step. Picking up that phone to call a creditor or collection agency used to terrify me. They can be very aggressive and intimidating when they call you so why call them? If you call a collection agency and tell them you just paid off their collection they change their tune very quickly. I called each of my collections after paying them off and asked nicely if there was any way they could remove the collection completely. 9 times out of 10 they said yes. They told me it may take up to 30 days though. If I didn’t see the item off in 30 days I would call them back and remind them. Some of them even came off within a few days!

If you have late payments, many companies will remove late payments as a courtesy to you. Call them and ask them. It doesn’t hurt and you will never know unless you ask. I had several credit cards that had 1 or 2 late payments that were 3 years old. I called the credit card company and explained whey I was late several years prior and many of them were very nice and remove the late mark. In the cases when they refused, I disputed online and/or sent letters to the credit bureaus requesting it removed.

build good credit

Don’t cut up your cards just yet. Put them away somewhere safe and remember to only use them if you have cash in the bank to pay them off each month or in emergency circumstances. Make your payments on time because you need to keep a 99% on time payment rate. Anything less is not good. Keep your balances low as well. If you can’t pay your balances off they need to stay under 30%. If you can get them below 20%, even better.

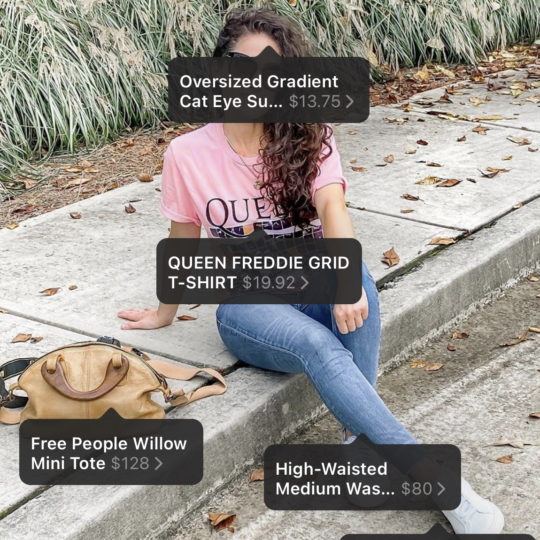

monitor your credit often

Once you have done all that you can to better your score sometimes you need to let things build and wait. Mistakes can happen though to be sure to monitor your report and score often. You can do this online or via your smart phone with different services offered by CreditRepair.com. They are one of the leading providers of credit report repair assistance in the United States. Their team of credit professionals can educate and empower individuals just like you to achieve the credit scores they deserve and they are standing by to help you too! Their technology provides each member with a personal online dashboard, as well as a complete analysis and tracking of their credit score. Members will also receive personalized credit bureau interactions, alerts via text and/or email, mobile apps and complete credit health monitoring.

everyone's situation is different

Let me say this is what worked for me. I received my tax return in February and started tackling things with that money. Tax season is a great time to do this since most of us receive a return check. I was a bit sad that I didn’t get to take a vacation or go shopping with the money but the most important thing was getting my family into a safe home and the first step was clearing all of the bad credit history. Within 2 months of doing the above steps my credit score shot up over 260 points and I was qualified to buy a home. Sometimes this process can take longer but you have to be aggressive in this process like I was and last April my husband and I purchased our very first home!

Does this all still sound really intimidating to you? I completely understand. I thought for years that I would just always be the girl with the bad credit, the credit score you have now is not set in stone. Don’t let that low credit score define you because you are so much more!. But the first step in moving forward is to not ignore it because it won’t fix itself. CreditRepair.com can truly help and guide you through this journey. Their goal is to help everyday people like you and me achieve their dreams. Whether your dream is to own a home, buy a car, or just to live debt-free they are here to help. Obtaining good credit and keeping it is a lifestyle though and not a temporary fix.

You can schedule a free personalized credit consultation with CreditRepair.com by calling can call 1-844-342-0762

Erica

Liked this post? share it on social!

This is such a helpful post! We have some credit card debt (not much, but still enough that feels like a dark cloud over our heads) that we’re working hard to pay off by the end of 2019! Already we are being smarter about how we use our cards and paying off any balance that we might spend right away on the cards that are already paid off.

Hi Erica! I also recently wrote a post on credit and really enjoy reading others perspectives. There is something that I think you may want to consider: instead of simply focusing on paying off small balances, focus on paying off the balances with higher APR rates first. These may actually contain more debt than the smaller accounts. For example, I have multiple student loans (because a separate account is opened each year I was in school), and the larger debt accounts have 7% APR, versus the small amounted accounts are at 5.5% APR. Anyway, thanks for sharing!

Yes I totally agree since those accrue the most in monthly interest !

This was such a good post. We have all our credit cards paid off. I just have my student loan to pay off, which isn’t much thank goodness.

I was brought up with that you can’t spend what you havn’t got! I never had debts in my life other then the for school. To many young people have debts already and that is a problem. It takes years to get over that.

Same here ….I just never listed to the advice ….then it was to late! Luckily i got myself out of that hole!

This is so important for not just millennials, but everyone to know! Having solid credit makes a lot of adult decisions in life so much easier.

Yes so true! It’s definitely good for everyone!

Wow some amazing valuable information. I definitely agree on calling the collection agencies after settling any debt and seeing if they can take take the debt off your record.